Big discussion on the blogosphere surrounding O’Reilly’s “web2.0” trademark. Tim O’Reilly prevented a not-for-profit organization using the term “web2.0” in its conference title, alleging trademark infringement. Though the dispute has been settled amicably, the communications from O’Reilly’s PR director has been very poor. In, fact my Communications Director would first flay me alive if I committed such a faux-pas, and then redress the damage to the company image a lot more effectively.

The problem is not so much the substance, but the appearance and perception by others of his trademark complaint. Tim is a champion of the hacking community, where commercial aggression is frowned on, and kudos comes from contribution to the commons and intellectual prowess. Tim is in fact a great champion of the patent abuse issues. He wrote Jeff Bezos an open letter complaining about patent abuse with Amazon’s one-click purchase patent request.

With such a dominant image among the creative commons community, which is his main customer base, Sara Winge, VP of Corporate Communications, should advice and influence Tim more strongly. In fact, I dont envy Tim’s return from holiday. Nevermind the rest of us commenting on his faux-pas; Tim’s biggest problem will be Sara Winge taking a baseball bat to his head.

Author: Paul Elosegui

Google strikes distribution deal with Dell

The deal, reported by The eStrategyOne Buzz, Dell will bundle Google Desktop software on its PCs, the open source Firefox browser and the Google toolbar. Under its terms, Google pays Dell an undiclosed sum per PC sold, and will last three years.

The deal, reported by The eStrategyOne Buzz, Dell will bundle Google Desktop software on its PCs, the open source Firefox browser and the Google toolbar. Under its terms, Google pays Dell an undiclosed sum per PC sold, and will last three years.

Bundling google software benefits the users. Microsoft’s Internet Explorer and msn landing site are acknowledged to be poorer than their google counterparty. Firefox browser and the google desktop search and particuarl favorites among converted users. The only reason for Microsoft’s dominance of the browser market is the precisely this pre-bundling its of the software. Dell users are unlikely to look back.

One in ten UK retail sales now online

ecommerce onlineretail

The UK’s “Office of Fair Trading has launched a fact-finding market study into online shopping Around 130,000 UK businesses now sell online. Internet sales are on a rampant growth curve. Further figures have been published by the IMRG, Netimperative – One in ten UK retail sales now online

The results show that 10% of all sales are now influenced by the internet, the breakdown is as follows:

- £30bn of retail spending is online, while £20bn of non-traditional retail such as gambling and banking is online.

- a further £30bn of offline retail sales is influenced by information gathered online

- in other words, £80bn of consumer spending is either online or influenced by the Web

Furthermore, the trend is growing faster, more than half of shoppers said they are planning to reduce their High street spending in 2006 while 45 per cent say that they are willing to increase their spending with online shops.

In addition, nine in ten (90%) shoppers researched goods online before buying them on the high street.

Do the best entrepreneurs wear jeans?

entrepreneurs creativeclasses

Funny post from David Beisel’s Genuine VC

In the limited subset of entrepreneurs pitching an early-stage venture firm in the Boston area, it seems that there is an inverse relationship between how formally an entrepreneur is dressed during the pitch and how potentially exciting their endeavor. Of course, the correlation isn’t perfect, and correlation doesn’t imply causation, but it is notable, especially given the “stuffy” reputation the area has vs. the rest of the start-up regions. Perhaps it is a symptom of the expression of confidence wearing something comfortable.

Dress is a definite sign of which side of the Creative Chasm the entrepreneur comes from. A wide cultural difference exists between the corporate mainstream manager and the contrarian creative artist. When the entrepreneur wears jeans at a corporate stronghold like a VC office, either he feels confident of his worth, i.e. “I may come from the creative mob, but look what I did”, or he is a creative class native with reason to be invited to a corporate office. Either way the cultural mismatch is a good sign of potential. Could be the birth of something.

I love the creative side of the divide. The early startup up period, which is all passion, exhilaration, and lateral thinking. It is the most fertile stage of a company. Unfortunately, the weight of accumulated customers, staff count, and the responsiblity of the paying monthly wages opens the way to structure process and rationality. Then you put your suit and tie on so as not to scare the shareholders, the corporate clients, and the corporate managers you have recruited.

There is definately something to jeans, the creative classes and crossing the chasm.

Contrarian attitude in Venture Investment

contrarian vc

Good post by Fred, on turnarounds and dark times in VC investments. I would say, in the best contrarian spirit, the best investments are made during the darkest times, when all you see are smouldering ashes of a business model.

It takes true vision and trust in fundamentals to go against everybody’s advice to give up. Or, as with many entrepreneurs, it takes a contrarian pig-headedness that relishes going against the mainstream trend. The trickiest part of bucking the trend, however, is timing. And that is when you need luck.

Entrepreneur Lifestyle

entrepreneur

Good post from Rajesh Jain, India’s premier entrepreneur

Talk of Blue Oceans and Black Swans an Entrepreneurs Lifestyle

As an entrepreneur, I have always bet on futuristic ideas. Most of the times they have not worked out. But that hasn’t stopped me from making the bets. That is the only way I know how to create new businesses. Until recently, I did not have a name for it. Now, I can term it as blue ocean strategy. The theory is easy to understand, but building a blue ocean business is tough. When one is trying to create a future that doesn’t exist, skeptics abound. This is where an entrepreneur has to keep the faith. There will be many testing moments through the venture the entrepreneur has to face up to them with confidence.

Till a venture takes off, it requires immense belief in the vision to live through the daily challenges. And if a venture is not taking off, it requires great courage to accept failure and move on in life. Either way, the entrepreneur’s life is about making difficult decisions and walking an often lonesome path.

This is not easy. Most of the time, I end up losing money. These are relatively small amounts of money I do not make bets which can wipe me out financially. I believe in making a few bets on what tomorrow’s world will be and hope that the companies I am involved in can execute well enough to not just make that future a reality but also be big winners. I didn’t have a name for this approach till I read Nassim Taleb’s book, “Fooled by Randomness”, And then a phrase came to me – I am a black swan entrepreneur.

Just like Nassim Taleb, who bets on extreme events as part of his investment strategy, I am betting on extreme ventures. These ventures are not about incremental change, they are about disruptive innovation. And as we were told again and again, most new ventures and products fail. But a few do succeed. Just because many new initiatives may have failed in the past, it does not mean that the next initiative will also meet the same fate. This is similar to seeing white swans. Just because one has not seen a black swan, one cannot conclude that it does not exist.

A good description of the trial and error fundamentals of successfull entrepreneurship. Not quite the turn of phrase used by Seth Godin in Zooming. Seth runs a mile with the whole embracing uncertainty concept. But good descriptions of entrepreneurial attitude and lifestyle are hard to come by.

In fact, little is successfully taught about entrepreneurial attitude. Formal “managing innovation” courses emphasize the systematics nature of making choices, with BCG matrices and weighting functions. Little prepares an MBA graduate, bursting with enthusiasm on graduation, for the day to day life of an entrepreneur. Like a goldminer setting out for the hills, the bad times are hard, while the good times ridiculous. Total volatility. MBA graduates can rarely stomach the extreme uncertainty, in wages and career path.

Early Adopters of Technology Do Not Make a Market

crossingthechasm geoffreymoore web2.0 earlyadopters startups

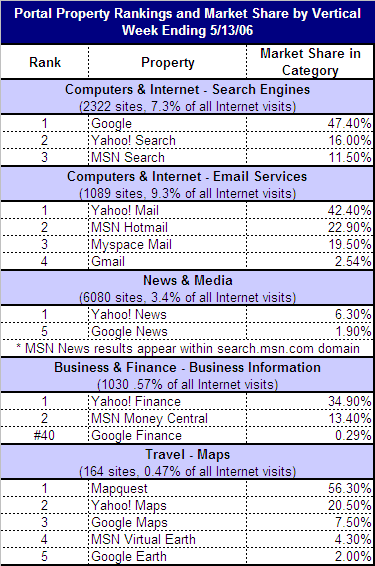

Web 2.0, the current frenzied trend in online technology is having difficulty attracting the majority of the market. In spite of the success with technology enthusiasts and early adopters, their share of the total online market remains low. Hitwise has just published market share statistics for internet search, email and news, which throws up a few surprises.

Note that the older services like, mapquest mapping services, get 10 times the traffic of google maps. Another surprise is that Yahoo Mail gets 20 times more traffic than Google’s Gmail, in spite of the more rudimentary features.

Many blog authors, who are a success among these early adopters, still need to attract mainstream visitors to make a living from their blog. Similarly, the popularity of web2.0 services like youtube and flickr is limited to early adopters , blog-users, causing the referred blog echo chamber effect. But, as the hitwise statistics show,

no impact on the mainstream so far.

The big mistake for web2.0 startups is that they are ignoring the mainstream market, not realizing that early adopters are a fickle customer segment when it comes to building profit. The rule of thumb among VCs is that the first 25,000 subscribers are irrelevant.

The big threat for web2.0 startups are that the mainstream online players like Microsoft, Yahoo and Google, who already have one foot on the mainstream market. They can adapt web2.0 ideas, make them easily understandable for the pragmatist, skeptical mainstreamers and make an easy introduction to their existing subscribers. A classic set piece scenario in Crossing the Chasm between early adopters and the pragmatist mainstream market.

Government’s Are Poor at Funding Growth Companies

paulgraham redundancies

Paul Graham is right about governments being poor at funding innovation growth. In his How American are Startups? speech, a candid analysis of how to create an innovation center like Silicon Valley, Paul damns government’s abilities to fund companies.

Government is not a good replacement for rich people / angel investors as they’re slow, invest inappropriately and don’t have the contacts or experience to support the right activity

I have never seen a Government backed program funding growth well. Myself and my partners spent two years in a institionally funded technology park that remained resolutely empty of companies during the 2000 boom. My company, which was funded through private and public equity investors, was the only company to contribute to the staff count in the park for almost two years.

I think VCs, business angels and self interested investors have no equal when creating long term regional growth.

[Paul’s speech is transcribed by Suw Charman and Tom Coates.]

A Drop of Sanity on the DRM Stranglehold

drm creativecommons

The opinion on the ruling is that it will reduce placeholder patents substantially. Patent plaintives will have a weaker position from which to negotiate an early settlement. The court ruled that the infringing party must only pay the amount of actual damage. This racket has cost tech companies and consumers billions in legal settlement fees. The legal contingency funds held by innovation based companies will not need to be so high in the future.

Boing Boing: Supreme Court makes it harder to be patent predator

The Supreme Court ruled earlier this week that injunctions shouldn’t be rubberstamped for patent cases. They specifically singled out business-method patents that are litigated by those who have no stake in producing the product or offering the service; i.e., patent trolls.

What this means is that patent trolls will be less likely to hold their victims for ransom through injunction unless the patentholder can demonstrate that they meet a four-part test, already in use for other injunctions involving equity, which is hard for a non-producer to meet. Even if a patentholder wins at trial, the defendent could file an appeal and still have injunctions in abeyence.

In essence, a plaintiff has to show irreparable harm, that mere money or other remedies when at trial aren’t enough, that there is an imbalance in hardships against the plaintiff, and that a permanent injunction wouldn’t harm the public interest. (IANAL.)

Email Delivery Neutrality Gone Forever

Delivering email newsletters to their clients has become a problem for smaller companies. The cause is the absense of email neutrality; the emerging tier system for classing email senders. Large corporations, like yahoo and Microsoft, have formed a top tier of email senders, and the small companies have been relegated to the bottom tier.

The struggle for email neutrality has been fought for years as email senders, like the small company newsletter authors, have fought to be included into the increasing number of email accreditation bodies. The struggle has been fought and ultimately lost.

Spam has forced several tiers of email senders onto the internet infrastructure. ISPs increasingly clear email based on not just blacklists like spamhaus.org, but also on white lists (or private accreditation organizations). The latest email accreditation list has been added by Goodmail, another email accrediation provider Goodmail Adds 15 ESP Partners

Goodmail, the e-mail accreditation provider generating controversy through its partnership with AOL, has signed up 15 new e-mail service providers to implement its CertifiedEmail service, including BlueStreak, Acxiom Digital, e-Dialog, Epsilon Interactive, ExactTarget, Harte-Hanks Postfuture, Responsys, Yesmail and Zustek.

On the receiving side, besides AOL, Goodmail is expected to be implemented soon by Yahoo, though no details have been shared.

The reputation space is wide open, with differing methodologies competing to see which can gain ground. Goodmail’s per-message fees strike some as the equivalent of e-mail postage, and has legislators and special interest groups whipped into a frenzy.

Other reputation providers, like Habeas and Return Path, take a more services-based approach, helping providers improve their sending practices instead of paying to send mail.

Which one of these methods will work best? Or will each find its own niche? Let me know what you think in the comments, or drop me a line at kevin-at-clickz-dot-com.

Nowadays large corporate marketing departments can buy good delivery of their mailing lists, whereas smaller company mailing lists do not get through.