I entered bitcoin in 2014. I diligently read the Satoshi paper and the O’Reilly “Mastering Bitcoin” bible by Antonopoulos. I installed a bitcoin node in the office and tried mining with a graphics card. Learnt the magic of cryptographically large numbers and generally joined the crypto faithful.

I had doubts though. I was never a maximalist. Going to the moon is fine, but how about we make Bitcoin and Ethereum useful. Bitcoin needed to either be a (1) store-of-value, (2) unit of account or (3) means of payment. Ethereum needed a killer-app; not crypto-kitties.

Coming from a traditional trading exchange, I tested orderbook slippage at various crypto exchanges and found the bitcoin price was too easy to manipulate. I was sceptical about its function as a store-of-value. Too many colluding whales, too much suspect wash trading by exchanges.

Nevertheless, I believed enough to continue with crypto projects.

In the past six years, bitcoin has emerged as a store-of-value. Here is my 2021 context for bitcoin as an alternative asset investment.

Traditional investment managers are sceptical, but overlook the fact that emerging asset classes have been part of finance for centuries.

Investment managers generate over 90% of their returns when allocating to investment asset classes. Selection within classes, fund selection and stock picking are typically secondary [1]. For general saving portfolios, a performance attribution analysis will flag asset allocation as the principal influence in the portfolio’s performance.

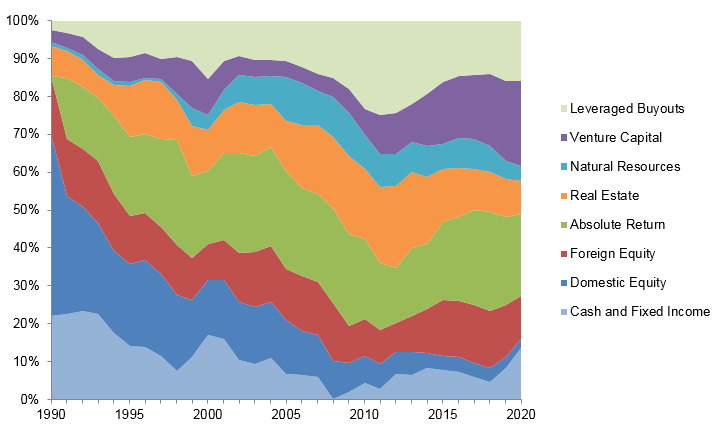

One the best examples of portfolio management is the Yale Endowment Management. With $31 billion under management, Yale’s Investment office is a reference on how to manage long term savings. Yale endowment’s asset allocation in particular has been exemplary for decades [3]

Optimizing a Portfolio

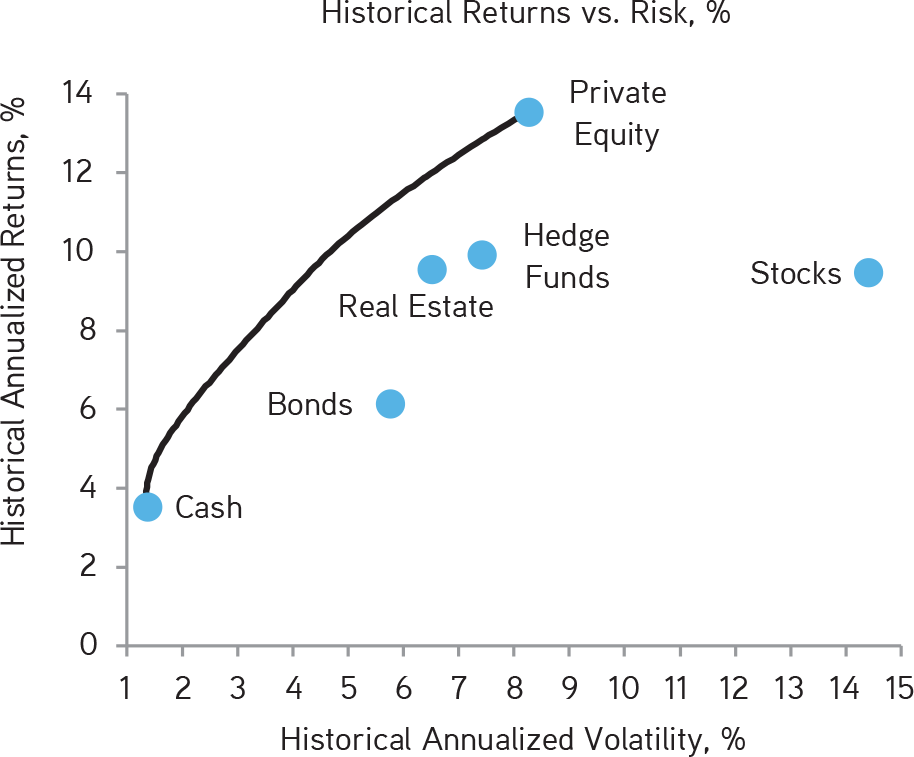

The visual for optimizing a portfolio is the returns vs risk graph, shown below. Each asset class has a different characteristic, and the risk vs return of the overall portfolio will be a function of the allocations made to each assest class .

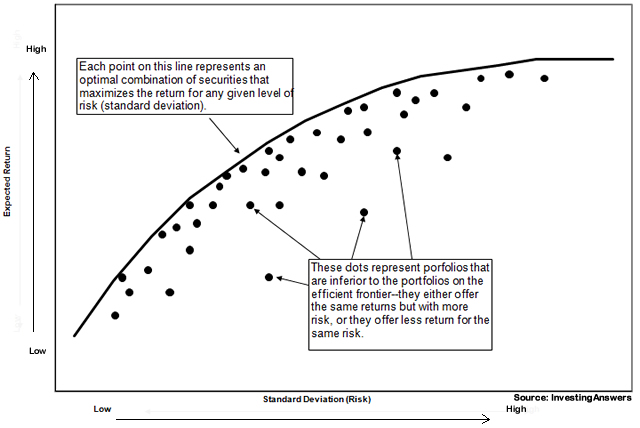

The efficient frontier line, shown in the graph below, represents the best of these securities combinations — those that produce the maximum expected return for a given level of risk.

The relationship securities have with each other is an important part of the efficient frontier. Some securities’ prices move in the same direction under similar circumstances, are correlated, while others move in opposite directions.

Harry Markowitz used the efficient frontier graph to demonstrate the power of diversification with un-correlated assets. He won the 1990 Nobel Prize for economics.

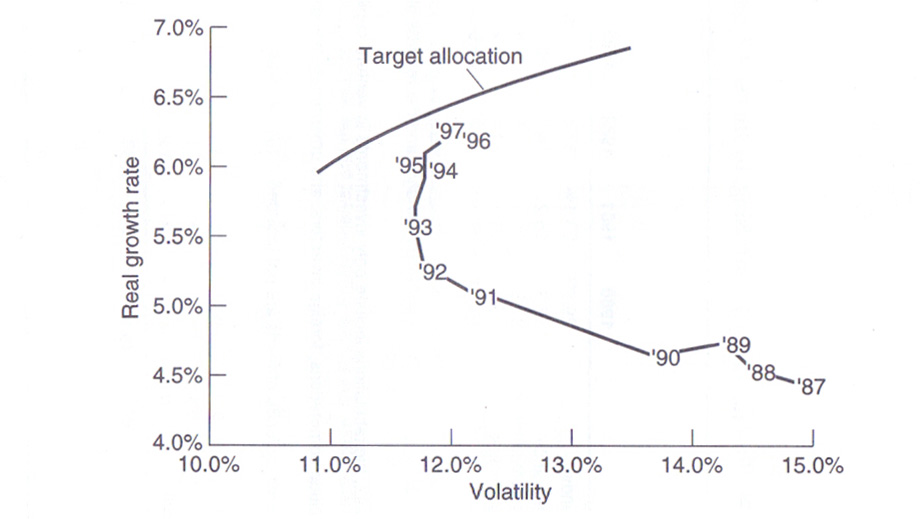

The graph below shows Yale Endowment’s pursuit of an efficient target allocation over a period of 10 years. Higher returns and lower volatility.

Yale continues to maintain a well-diversified, equity-oriented portfolio, with the following asset allocation targets for fiscal year 2021:

| absolute return | 23.5% |

|---|---|

| venture capital | 23.5% |

| leveraged buyouts | 17.5% |

| foreign equity | 11.75% |

| real estate | 9.5% |

| bonds and cash | 7.5% |

| natural resources | 4.5% |

| domestic equity | 2.25% |

Yale targets a minimum allocation of 30% of the endowment to market-insensitive assets (cash, bonds, and absolute return). The university further seeks to limit illiquid assets (venture capital, leveraged buyouts, real estate and natural resources) to 50% of the portfolio.

Combining Non-Correlated Assets

When combining negatively correlated assets the portfolio’s risk return will in theory improve. When one asset is down, the other asset is up, reducing volatility.

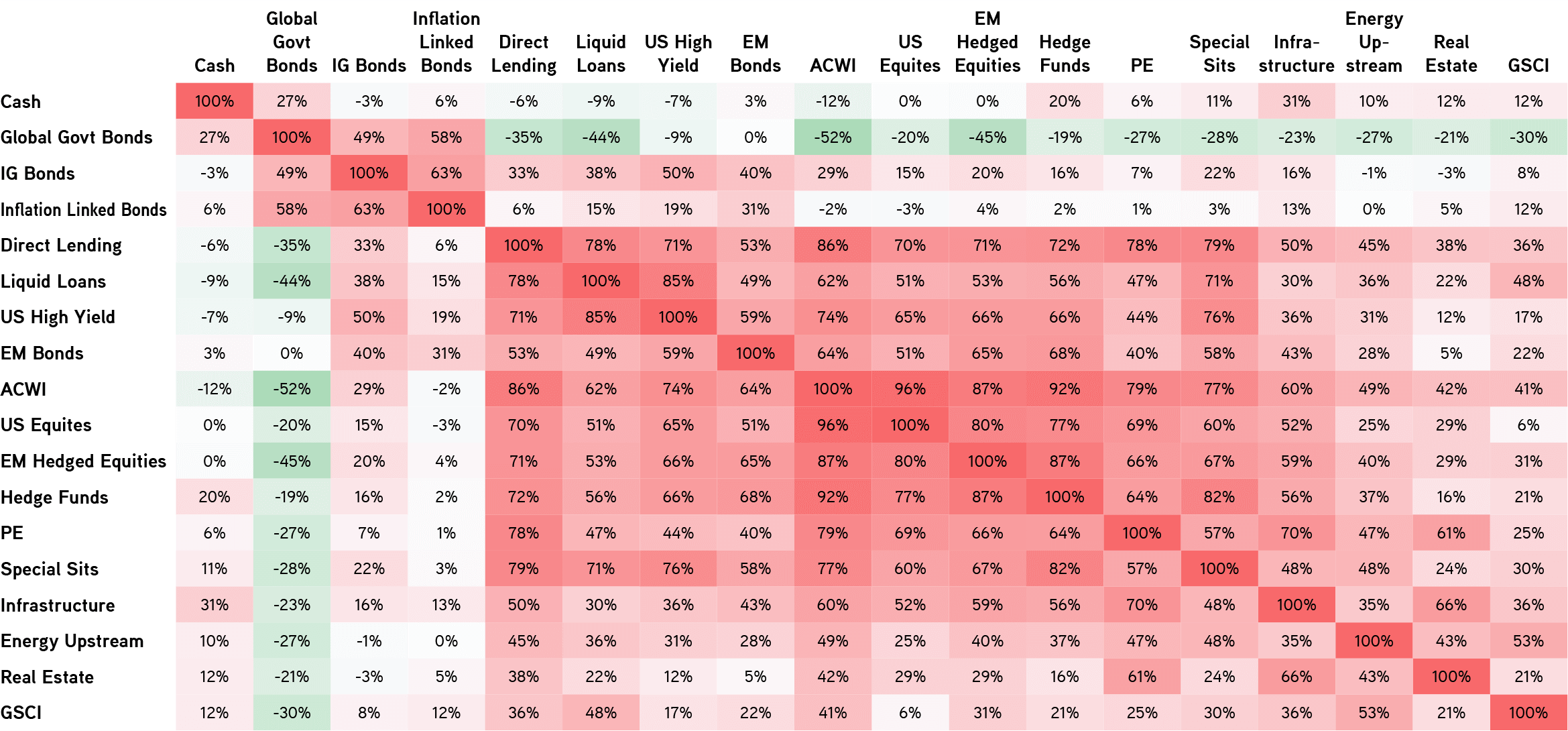

So, in addition to return on investment and volatility, asset classes are judged on correlation to principal asset classes like public equity and fixed income

Alternative Asset Classes

Yale Endowment’s above average performance has been attributed to their search and allocation to new emerging asset classes.

Post World War, Yale moved away from traditional liquid asset classes and targeted illiquid investments, like private equity and venture capital. The illiquidity premium brought over-large returns for decades.

Real estate and commodity asset class brought another decade of overlarge returns.

In the current environment, with Quantitative Easing, and lower forward return forecasts, alternative asset classes are forecast to bring alpha and safe-haven correlation to portfolios [4].

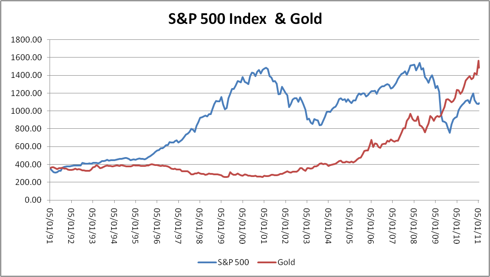

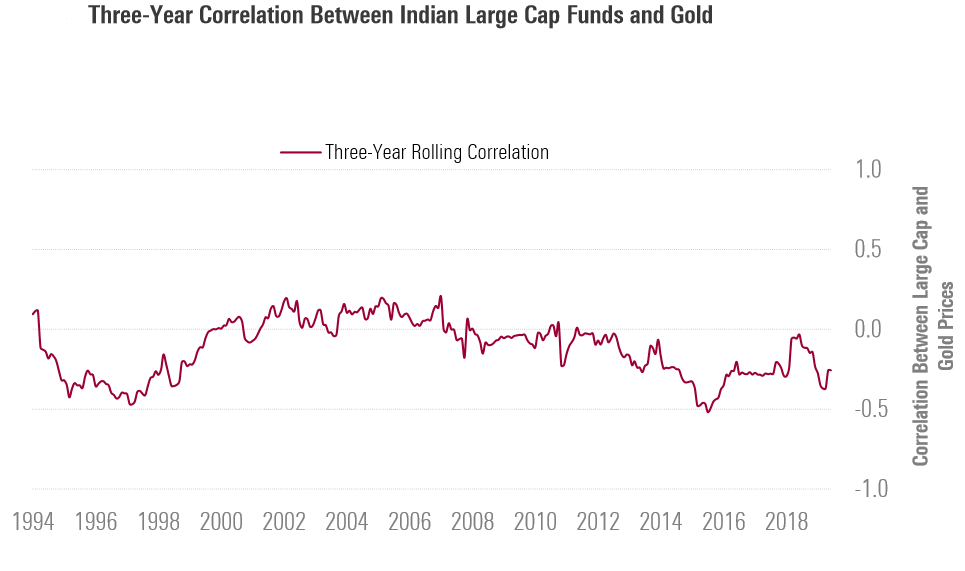

Alternatives like Gold are often weighted during difficult economies. In periods of extreme instability, investment managers seek refuge in gold, silver, copper, as safe-havens rather than yield plays. As shown by the price graph below gold can provide negative or no correlation to public equities.

New Alternative Assets

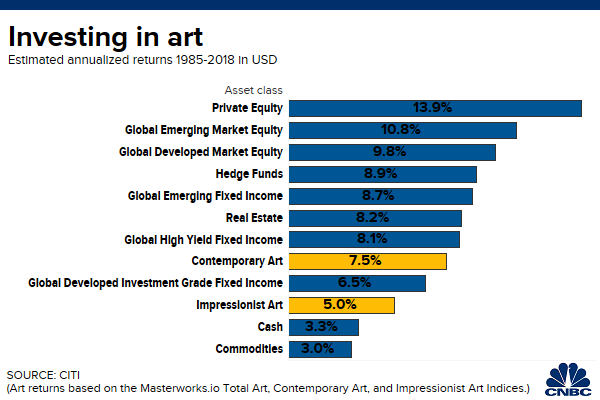

New store-of-value assets emerging in recent years include Art collectables, and crypto currencies.

In 2017 the global art market topped $67 billion. Since 1985 contemporary art has been the best bet for investors of the asset class, returning an average of 7.5% per year, Citi said in a report using data from Masterworks.io. Impressionist art averaged 5.0%, while the art market as a whole returned 5.3% annually.

Since 1985 contemporary art has been the best bet for investors of the asset class, returning an average of 7.5% per year, Citi said in a report using data from Masterworks.io. Impressionist art averaged 5.0%, while the art market as a whole returned 5.3% annually.

The leading art index, created by Jianping Mei and Michael Moses, using “same sales” data from public auctions calculated a long-term correlation coefficient of 0.04 with the S&P 500.

Though the Mei-Moses art index issues, and and correlation data is still non-conclusive, the collectibles asset class is becoming attractive. Better trading transparency and liquidity through new collectibles marketplaces is behind the trillions of dollars stored in this asset class.

Bitcoin and Crypto Currencies

Described as the ultimate store-of-value [10], bitcoin and crypto-currencies are increasingly used as alternate asset classes in professional investment portfolios[11]. Bitcoin crossed $1 trillion market capitalization in 2021. Though an order of magnitude less than gold, it’s importance as a store-of-value in no longer questioned.

Current expert recommendation[11] is 1% – 5% of portfolio weighting.

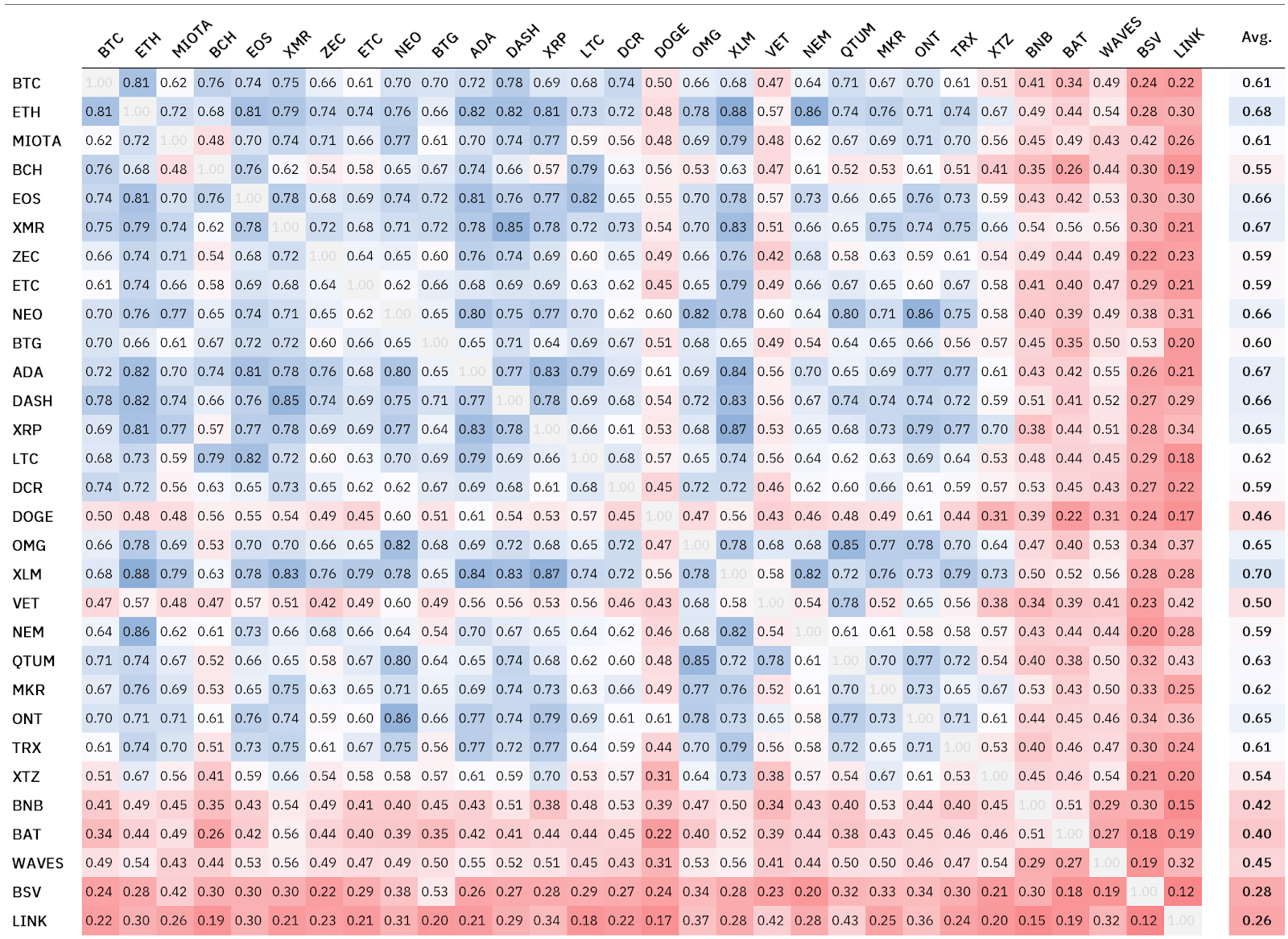

Bitcoin holds the principal part of crypto capitalization. The remainder of digital assets are highly correlated to bitcoin, as shown in the correlation table below. The majority of coins exhibiting correlations above 0.5 with other cryptoassets.

Digital Collectibles – NFT

Collecting Art is about uniqueness as well beauty. Digital Art like music, images, video, have long been handicapped by the difficulty of claiming ownership and author’s rights. Cryptographic signatures and a distributed ledger provide this uniqueness, and Non-Fungible Tokens (NFT) fix the provenance problem.

Lack of liquidity is investment art’s Achilles heels. Buying into the long tail of art works is easy, selling obscure artists is hard[6].

New marketplaces are emerging though; opensea.io, rarible.com, niftygateway.com or superrare. Better search engines for Art’s long tail will without doubt improve market depth and liquidity. The financial instruments to make it a viable investment class, insurance, futures, options, settlement, clearing are on the way.

All you have to do now is spot the next Banksy. Online.

Conclusion

The hunt for new asset classes for investment is the future of portfolio performance, always has been. Yale has yet to add digital assets to its portfolio, so it is not yet too late to buy. Timing though. That is difficult.

Reference

- Pension Fund Management – Arun S. Muralidhar, Stanford Economics & Finance, 2000.

- Yale Investment Office

- Venture Capital & Private Equity, Josh Lerner, Wiley, 1999.

- Rethinking Asset Allocation Henry McVey, KKR, 2018

- The Efficient Frontier, Harry Markowitz, Modern Portfolio Theory, 1990 Nobel Prize.

- Why Investing in Fine Art is Different Than Investing in Traditional Asset Classes, Doug Woodham, 2018.

- Why should art be considered an asset class, Adriano Picinati di Torcello, Deloitte Art and Finance, 2010

- Buy a Monet instead for treasury? Art has shown long-term returns to rival bonds, Pippa Stevens, CNBC, 2019

- Why art should be in every investor’s portfolio, Masha Golovina, Masterworks.io, 2018.

- Bitcoin is a Collector’s Item Meltem Demirors, Coinshares, 2020.

- A little Bitcoin Goes a Long way James Butterfill & Christopher Bendiksen , Coinshares, 2020.

- The Case for $500k Bitcoin, Tyler Winklevoss, 2020

- Bitcoin Investment Thesis, Ria Bhutoria, Fidelity Digital Assets, Oct 2020.

- The NFT Landscape, James Bennett, Bytetree, Oct 2020.