The debate between long-term and short-term concerns never stops in a company, specially in growth industries. Google is already having “The Debate”, in its “we are a technology company rant”.

It takes place between the operations and the strategy teams. Between the Chief Operations officer and the Visionary founders. For a successful company, they are the two faces of the same coin. Long term can’t survive without short term. The daily grind can’t succeed without the long term investment. It is a bad sign when the debate stops.

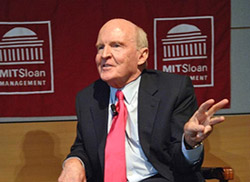

Corporate managers, with the rational black-hat, excel sheet approach rarely push the creative, disruptive agenda. So it is refreshing to get Jack Welch weighing in on the creative class side: he states that “anyone can squeeze a company”.

“Look, anyone can manage for the short term just keep squeezing the lemon. And anyone can manage for the long just keep dreaming. You were made leader because someone believed you could squeeze and dream at the same time. They saw in you a person with enough insight, experience, and rigor to balance the conflicting demands of short- and long-term results. Performing balancing acts every day is leadership

from Jack Welch on leadership, in his new book “Winning”.

Corporate class warriors are no longer solely central to corporations. A healthy company needs creative and disruptive skills, not just an admin and management team. The mix is not easy though; corporate culture has difficulty with uncertainty, risk, irrational decisions, volatility, disruption, and continuous change. Takes strong corporate management to be continuously challenged in this way.